The Basic Principles Of Financial Advisor Victoria Bc

The Basic Principles Of Financial Advisor Victoria Bc

Blog Article

Things about Independent Financial Advisor copyright

Table of ContentsThe Best Guide To Ia Wealth ManagementA Biased View of Independent Financial Advisor copyright7 Easy Facts About Ia Wealth Management Explained6 Easy Facts About Retirement Planning copyright DescribedExcitement About Independent Investment Advisor copyrightFascination About Investment Consultant

“If you used to be to purchase something, say a television or a computer, you'd need to know the specifications of itwhat tend to be their elements and what it can do,” Purda details. “You can contemplate getting economic advice and support in the same manner. Men And Women must know what they're buying.” With financial guidance, it's important to keep in mind that the merchandise isn’t securities, shares or any other investments.It’s things such as budgeting, planning your retirement or paying down financial obligation. And like purchasing a pc from a reliable business, people wish to know they've been getting economic advice from a trusted professional. One of Purda and Ashworth’s most fascinating findings is about the fees that monetary planners demand their clients.

This conducted true irrespective the charge structurehourly, commission, assets under administration or predetermined fee (within the study, the dollar worth of charges ended up being similar in each instance). “It still boils down to the worthiness idea and uncertainty from the people’ part that they don’t know very well what these include getting back in trade for these charges,” says Purda.

Some Of Financial Advisor Victoria Bc

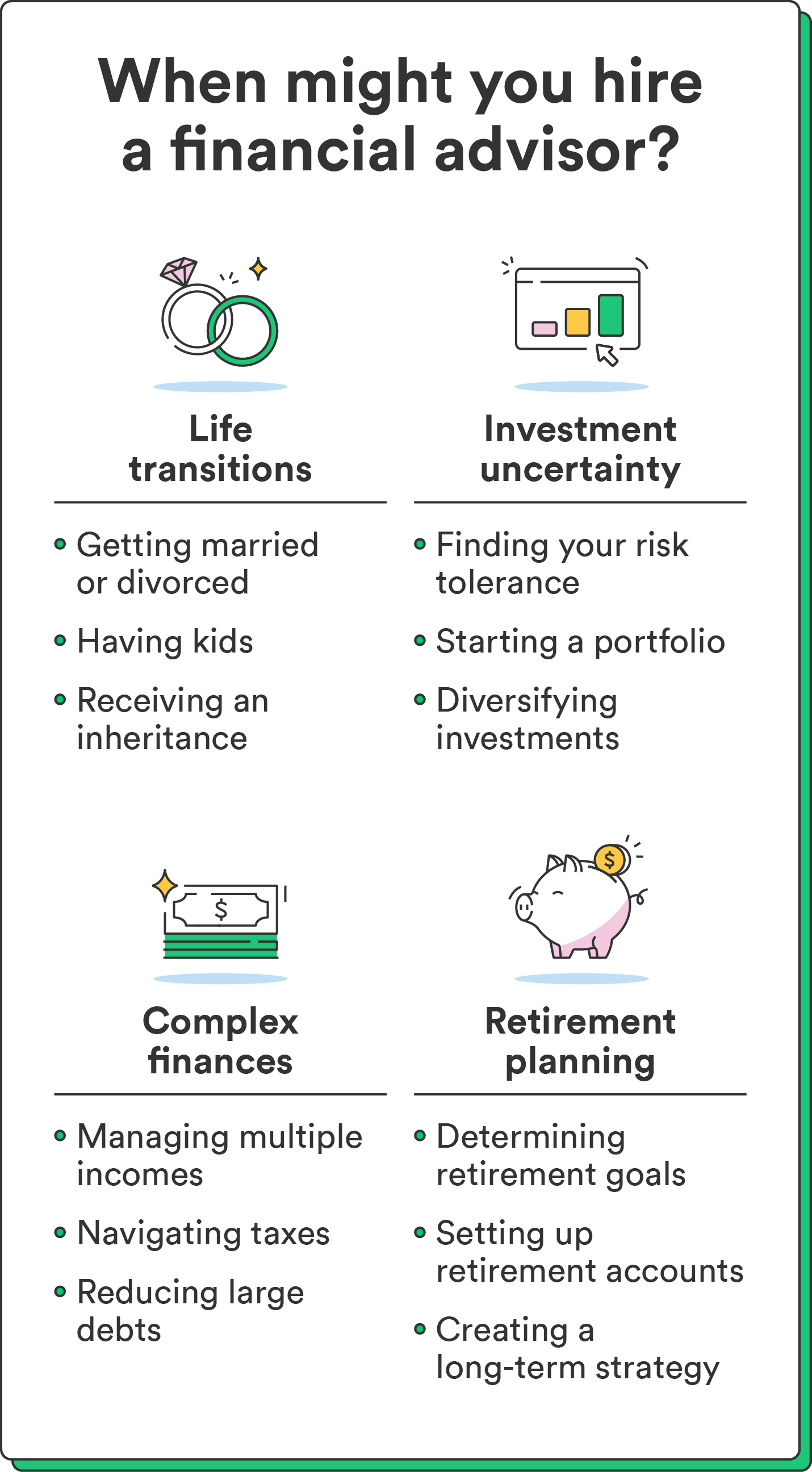

Tune in to this short article once you listen to the phrase economic consultant, exactly what one thinks of? Lots of people think of a professional who is going to let them have economic guidance, particularly when considering investing. That’s a good place to begin, however it doesn’t decorate the entire picture. Not even near! Financial advisors can really help people with a bunch of other money targets as well.

An economic expert makes it possible to build wide range and shield it for all the long term. They're able to estimate your future financial needs and plan how to extend your your retirement cost savings. They are able to also give you advice on when to begin making use of Social safety and ultizing the funds inside retirement reports so you're able to stay away from any awful charges.

The Independent Investment Advisor copyright Statements

They may be able assist you to determine what shared resources are right for you and demonstrate just how to handle to make more of one's financial investments. Capable additionally allow you to understand the threats and exactly what you’ll have to do to accomplish your aims. A seasoned financial investment pro will also help you stay on the roller coaster of investingeven when your investments simply take a dive.

They are able to provide you with the advice you'll want to make an agenda to help you ensure your desires are carried out. While can’t put a cost label about satisfaction that include that. In accordance with research conducted recently, the typical 65-year-old few in 2022 should have about $315,000 stored to pay for healthcare expenses in your retirement.

Not known Details About Retirement Planning copyright

Since we’ve reviewed exactly what financial advisors perform, let’s dig into the different kinds. Here’s a great guideline: All monetary coordinators tend to be monetary experts, not all advisors tend to be coordinators - https://www.livebinders.com/b/3567174?tabid=aaafba60-2a7e-3bde-f5e7-f44030d8dc70. An economic coordinator is targeted on assisting men and women produce intentions to attain lasting goalsthings like beginning a college investment or keeping for a down cost on a house

So how do you understand which economic consultant suits you - https://dribbble.com/lighthousewm/about? Below are a few activities weblink to do to make sure you’re choosing the proper person. What do you do when you yourself have two terrible choices to pick? Simple! Discover a lot more possibilities. The greater amount of solutions you really have, the much more likely you happen to be to make an excellent decision

Indicators on Lighthouse Wealth Management You Should Know

All of our Intelligent, Vestor system can make it simple for you by showing you up to five financial experts who can serve you. The best part is, it’s completely free to get associated with an advisor! And don’t forget to come quickly to the meeting prepared with a list of questions to inquire about in order to decide if they’re a great fit.

But pay attention, simply because a specialist is actually smarter versus normal bear does not provide them with the right to let you know what you should do. Sometimes, advisors are loaded with on their own since they do have more levels than a thermometer. If an advisor starts talking down for you, it's time for you demonstrate to them the doorway.

Just remember that ,! It’s essential plus financial consultant (whoever it eventually ends up being) take the same web page. You need a consultant who's a lasting investing strategysomeone who’ll encourage you to hold spending regularly if the market is up or down. independent investment advisor copyright. You additionally don’t want to use a person that pushes that buy something that’s too dangerous or you’re unpleasant with

10 Simple Techniques For Investment Consultant

That combine will give you the diversification you ought to effectively invest your longterm. Whenever study monetary advisors, you’ll most likely come upon the term fiduciary duty. All this work suggests is actually any consultant you hire has to work in a fashion that benefits their own client rather than unique self-interest.

Report this page